What Is A Typical Rent Increase In Charlotte NC

Charlotte NC is one of the rapidly expanding cities in the United States. With its healthy economy, cultural vibrancy, and attractive lifestyle, more people have been migrating to this Queen City. This fast growth heavily affects the local property market, especially for renters. Existing and future tenants must grasp what constitutes Charlotte's average annual rent increment.

Current Rent Trends in Charlotte

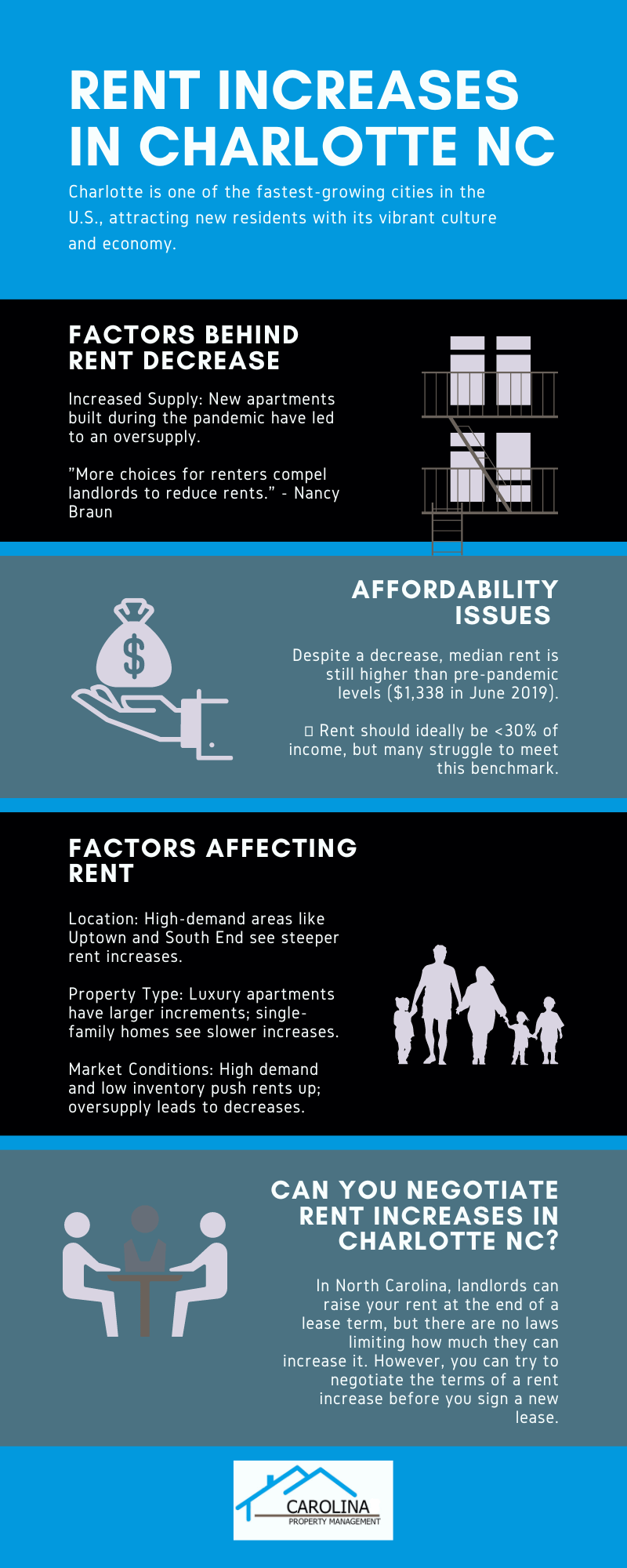

Recent data from Realtor.com indicates a decrease in rent prices in Charlotte. As of 2024, rent prices have declined by 5.2% from 2023, with the current median rent in Charlotte at $1,527. Charlotte is among the cities with the largest rent reductions, though some cities like Nashville, San Antonio, and Austin have seen even greater decreases.

Factors Contributing to the Decrease

The primary driver behind the decrease in rent prices is the increased supply of rental apartments. During the pandemic, many new apartments were built in Charlotte, resulting in an oversupply of available units. This surplus has led landlords to lower their prices to stay competitive and attract tenants.

According to Nancy Braun, owner of Carolina Property Management and Showcase Realty in Charlotte NC, the significant increase in newly constructed apartments has provided renters with more choices, compelling landlords to reduce rents to avoid vacant units.

Affordability Concerns

Despite recent declines in rent prices in Charlotte, housing affordability remains an issue for many residents. As of June 2024, the median rent was $1,527, which is higher than the $1,338 median rent recorded in June 2019. So, even with the recent decrease, rent prices are still more expensive than they were before the pandemic.

Generally, rent should not exceed 30% of an individual’s gross monthly income. But many people in Charlotte are struggling to meet this benchmark because rent prices have risen faster than wages. Nancy Braun explains that, even though rents have decreased somewhat, people’s incomes haven’t risen enough to cover rent and other living expenses such as utilities and groceries.

Because of this gap between income growth and housing costs, many renters are feeling more financial pressure. Even with more apartments available, not everyone is finding affordable housing. For a lot of people, rent is still too high.

What Factors Affect the Cost of Renting?

Location

Location plays a significant role in dictating the cost of rent and its increase. Uptown, South End, and NoDa are some of the neighborhoods located near the central business district that experience higher rent increases due to their proximity to amenities, employment hubs, and entertainment spots. These areas are in high demand, but the limited availability of rental units drives up prices.

Conversely, suburban areas, which are located farther from the city center, may experience more moderate rent increases, though they still follow general market trends.

Property Type

The type of rental property matters too. Luxury apartments and condos in desirable places usually have large rate increments. Such places are found with all modern facilities and are often situated in high-demand neighborhoods, which justifies the increased rent charges.

Single-family homes, especially in family-friendly neighborhoods, also command higher rental rates, though the rate of increase may be slower compared to luxury properties.

Market Conditions

Rental pricing is also heavily influenced by market conditions. Landlords can hike rents higher during periods when demand is high yet and inventory is low; however, they may need to reduce the amount charged whenever there is an oversupply of available rental units.

Employment growth also affects rental costs – if wages rise, rent prices rise accordingly, while a slow economy could push rents down.

Can You Negotiate Rent Increases in Charlotte NC?

In North Carolina, landlords can raise your rent at the end of a lease term, but there are no laws limiting how much they can increase it. However, you can try to negotiate the terms of a rent increase before you sign a new lease.

Here are some helpful tips to help you negotiate, according to U.S. News:

Sign a Longer Lease

One effective approach is to offer a longer lease term, such as 18 or 24 months. Landlords may prefer this because they value the stability of a long-term tenant, and they might lower the rent increase for you in return.

Pay Rent Upfront

If feasible, propose paying several months’ rent in advance. This demonstrates your financial stability and provides the landlord with immediate cash flow, potentially leading to a reduced rent increase.

Maintain a Good Credit History

A strong credit history and a consistent record of on-time rent payments can enhance your negotiating position. Landlords value reliable tenants, and this could help you negotiate a smaller rent hike.

Highlight Your Value as a Tenant

Landlords often appreciate tenants who maintain the property, have good relationships with neighbors, and avoid causing issues. Highlighting these positive qualities can be a persuasive argument for a smaller rent increase, as finding new tenants is time-consuming and costly for landlords.

Time Your Negotiation

Initiate discussions about the rent increase approximately 30 to 60 days before your lease expires. Don’t wait until the last minute, but don’t bring it up too early either.

Research Comparable Rentals

Research rental prices for similar properties in your area. If you find that comparable units are cheaper, you can use this information in your negotiations to argue for a more reasonable increase.

Stuck with an Unsold Home? Here’s What You Can Do

— Carolina Property Management LLC (@CarolinaPropMgm) September 26, 2024

Struggling to sell your home? Don’t worry, you still have options! In this video, we explore effective strategies to help you move forward, from adjusting your price to renting out the property. pic.twitter.com/E8pF4GsfsC

The Rental Market in Charlotte

The rental market in Charlotte NC is subject to constant fluctuations due to various factors that affect rent prices and housing demand. If you’re renting, it’s important to know what causes these changes, keep pace with market trends, and plan for possible rent increases. Monitoring changes in popular neighborhoods and adjusting your budget based on this can help you make informed housing decisions.

For professional help with your rental, property management, investment and real estate needs, Nancy Braun and Carolina Property Management offer extensive experience in the Charlotte real estate market. Nancy and her team provide professional advice and support to renters, landlords, investors and homeowners, helping you navigate the local housing market.

Think about buying vs renting. Here are some tips… CLICK HERE

You can call Nancy Braun at 704-286-9844 or reach out to Carolina Property Management for all your property management and real estate needs in North Carolina and South Carolina.