There’s another way to pay for houses and buildings that’s not like the usual bank loans. Some investors and property developers pick these ‘hard money’ loans for their projects.

These loans can cost more. But they can give you chances to make money that regular loans don’t offer.

Three reasons show how, even though these loans are pricey, they can help homeowners in real estate transactions.

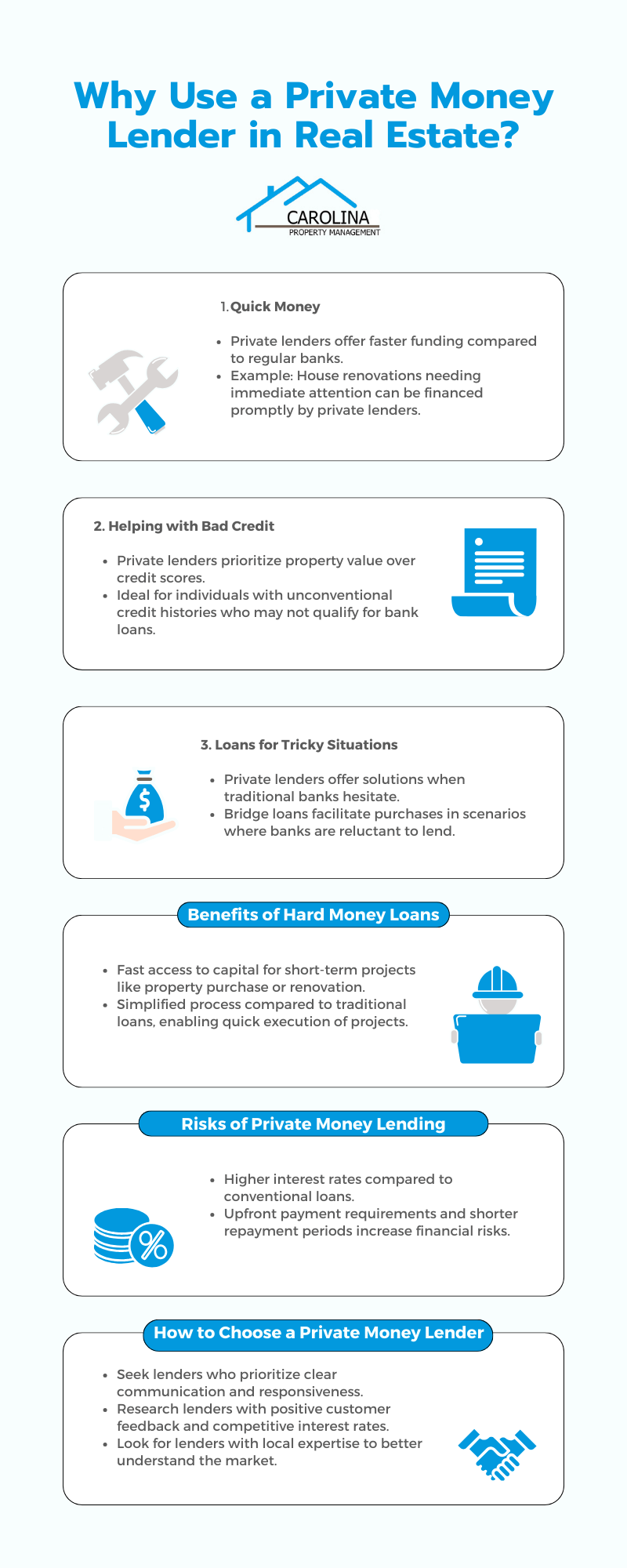

Why Use a Private Money Lender in Real Estate?

1. Quick Money:

Private lenders lend money faster than regular banks. If a house needs fixing, but regular banks won’t help, private lenders step in. For example, if a house is taken by the bank because the owners can’t pay for it, a developer can buy it.

Then, using money from private lenders, they fix it so a regular bank will give them a loan. This helps the owners keep the house, and they get money when it’s sold after fixing it.

2. Helping with Bad Credit:

Private lending helps people who don’t have good credit scores. Regular banks care a lot about credit scores. Private lenders care more about whether the property can be sold quickly after it’s bought.

This means they can lend money to people with unusual credit histories who wouldn’t get a loan from a regular bank. In these cases, borrowers often must pay a lot of money upfront.

3. Loans for Tricky Situations:

Private lenders help when regular banks won’t. For example, when someone wants to buy a house already for sale. Regular banks don’t like lending money in these situations. But private lenders can. They give a “bridge loan” to help another property.

Regular banks don’t like these short-term loans, but private lenders do. They guarantee a clear plan for when and how the loan will be paid back once the property is sold.

What are the Benefits of a Hard Money Loan?

Hard money loans are a fast way to get money for short-term projects, like buying or fixing a property. These loans give quick access to cash, making buying or fixing a property easier. It’s helpful when regular lenders don’t want to fund quick projects.

Regular loans take a long time and need lots of rules. Hard money loans are more straightforward. They still have rules, but getting the money is faster. This helps investors get money without waiting for paperwork.

With hard money loans, what matters most is how much money a property can make, not a person’s credit. Even if someone has a short credit history, they might still get a hard money loan. This helps new investors or those with shorter credit histories get money.

Hard money lenders are more flexible than regular lenders. They allow borrowers to discuss repayment terms, including interest rates and duration. This helps investors match the loan terms with their financial plans.

Hard money loans are great for big, complex property projects. They provide money at different project stages.

What are the Risks of Private Money Lending?

Private lenders often charge more interest than regular loans. This helps you get the money faster but makes borrowing more expensive. If your property doesn’t make money, these high rates can cost you a lot and affect your profit.

Getting a hard money loan means paying a lot upfront, around 25% or more of the property’s value. This big payment might tie up much of your money, making using that cash for other investments hard.

Hard money loans must be paid back, usually in a few months to a few years. So, you’ll have to sell the property fast or refinance it to pay the loan back on time. You might have to pay more interest or lose the property if you can't.

These private loans have fewer rules compared to regular loans from banks. You must be extra careful and check everything before agreeing to these loans.

Private lenders may add extra fees in the loan agreements that borrowers don’t know about at first. These costs can make borrowing more expensive and might hurt your expected profits.

Getting private loans might be tricky if you don’t know many lenders in the area. Finding the right private lender could be more complicated than regular loans.

How to Choose a Private Money Lender in Charlotte, NC

Pick lenders who are easy to talk to and help you with questions. Having someone who listens and responds quickly can make your decisions easier.

Choose lenders who explain everything about the loan clearly. Understanding everything about what you’re getting into is essential.

Look for lenders with happy customers. If people say good things about a lender, they’re good at caring for their customers.

Look at different lenders and see who gives you the best interest rate for your money plans.

It’s good to find lenders who understand how things work in Charlotte. They’ll know more about the area you’re investing in.

Private money lending in real estate offers flexible solutions for different situations. It’s handy when traditional lending ways have limitations or time constraints.

Knowing Charlotte's property market is essential for successful real estate deals. Nancy Braun knows lenders who understand how Charlotte’s property market works.

Choosing the right private lender means finding someone who matches your investment needs. Nancy Braun can help connect you with good lenders and guide you to make smart choices. You can call Nancy at 704-286-9844 to learn how private money lending can help your real estate plans.